Calculating Home Equity

Calculate Your Home Equity: A Step-by-Step Guide

Understanding home equity is important because it is a key factor in your net worth and borrowing ability. This figure is the value of your home minus mortgage debt.

Key Points:

- Calculating home equity is a straightforward formula

- You can use home equity to secure a loan or line of credit

- Lenders typically want to see equity of 20% or more

In this article, you will find our step-by-step guide on:

- How to calculate your home equity

- How to determine how much you can borrow

- How to access your home equity

What Is Home Equity?

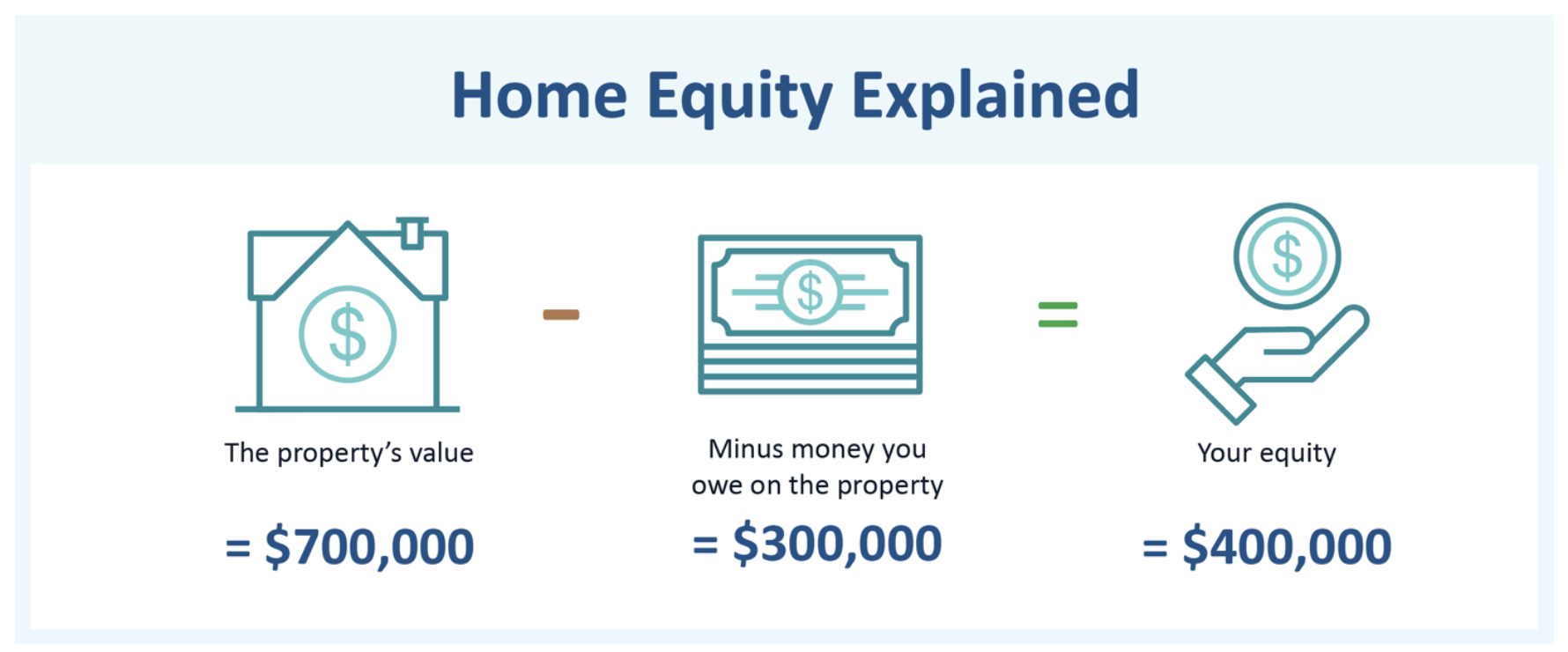

Home equity is the difference between your home’s current value and what you owe on it. Or, in other words, it is the value of what you actually own right now.

For western Washington homeowners, building equity starts with your down payment and grows from there as you make payments on your mortgage. In the early years of a mortgage, more of each payment goes toward interest than principal, so your equity builds more quickly as time goes on.

Your home equity is a cornerstone of your financial security. For many people in western Washington, a home is their most valuable asset and investment. It’s also a source of borrowing power because home equity can secure loans. Loans secured by home equity usually offer lower interest rates than personal loans.

That makes home equity a potential source of money for home renovations, paying off high-interest debt, emergencies, and education expenses.

How to Calculate Your Home Equity Step-by-Step

For these reasons, it is important to know how much equity you have in your house. Here are the steps for calculating home equity.

Determine your home’s value: Figure out how much your home is worth. A precise valuation would require a professional appraisal. But, that is typically not worthwhile at this point for reasons we will explain shortly. For now, an educated estimate is fine.

There are a number of ways to arrive at an estimated value of your home.

- Purchase price - If you bought your home within the last six months or so, the purchase price is a good number to use unless there have been major shifts in the real estate market.

- Recent selling prices - Look at the sales prices of houses similar to yours in the same area and extrapolate.

- Ask a real estate agent - A western Washington agent can do a full-blown comparative market analysis, but brokers typically do not want to do this work unless there is a strong likelihood that you will contract them to sell your home. If you don’t have plans to sell, you could ask a friendly agent for an off-the-cuff figure. This number will not be as accurate, so it’s best used to corroborate other data sources.

- Online estimates - Real estate websites like Zillow and Redfin list property valuations, often giving a range. These are computer generated based on a formula and are a good starting point.

- Market-adjusted values - If you purchased your home in the last few years, use the purchase price and adjust it for market trends. Search online for real estate trends for your Washington town or county. Usually, a real estate association will publish an annual report with the average increase or decrease in home prices. Using your purchase price as a baseline value, adjust accordingly.

Figure out how much you owe on the property: For most people, the amount owed is the remaining balance on their mortgage. You can find this number on a recent mortgage statement.

If you have a second mortgage or other loan secured by the property, add this debt to the mortgage amount. This will give you the amount of total debt on the property.

Subtract debt from the home’s value: Use the basic formula for calculating home equity, which is home value minus the amount owed.

Value of house - Amount of debt = Equity

Examples of Calculating Home Equity

Let’s look at some examples of how to calculate your home equity.

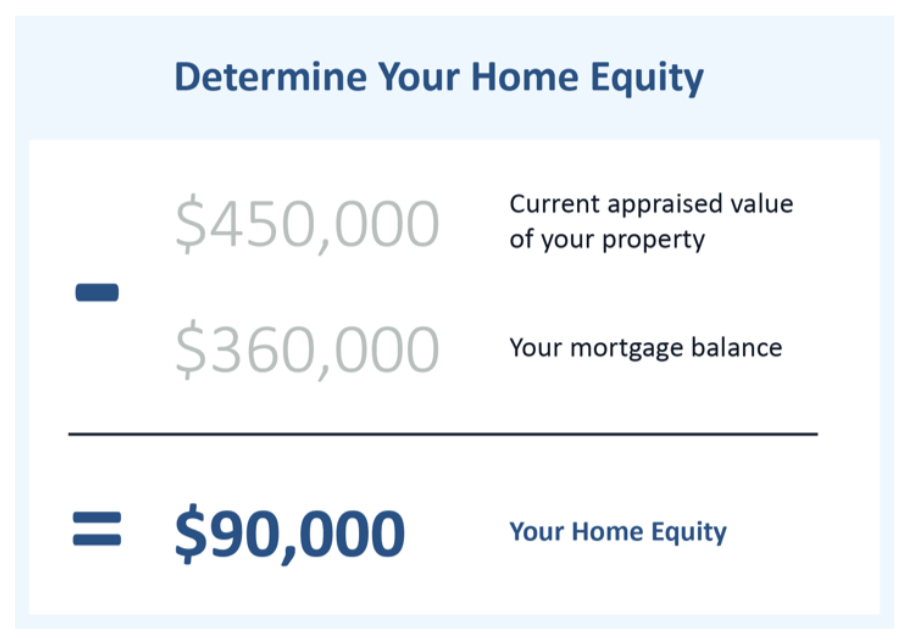

Example One:

The Patel family just bought their first home for $450,000. They put down 20% or $90,000. They financed the rest, $360,000, with a mortgage. They can calculate their home equity by subtracting $360,000 from $450,000. It’s $90,000, equal to the amount of their down payment.

Example Two:

In a more complicated example, the Robinson family bought a condominium 15 years ago for $325,000. They made a down payment of $65,000 and took on a mortgage of $260,000.

Five years ago, they took out a $50,000 home equity loan to renovate their kitchen and bathrooms.

To figure out the Robinsons’ home equity, the family looks at the prices of two very similar units in their building that recently sold for $600,000 and $650,000. The first did not have any updating while the second had more extensive renovations than the Robinsons undertook. They look online and see an estimate of $635,000 for their unit. That seems on track with the sales prices.

By looking at their mortgage statement, they see that they still owe $175,000 on it. They also owe $22,000 on their home equity loan. That makes their total debt on the property $197,000. To calculate the value of their home equity, they would do the following math:

$635,000 - $197,000 = $438,000

Estimated value of property total amount owed home equity

This same calculation would tell the Robinson family roughly how much they would make if they sold their condominium for the estimated value. (In reality, it would be somewhat less because of costs like broker fees, taxes and any money spent getting the property ready for sale. But it could also be more if the home sells for higher than the estimated value.)

Home Values Fluctuate, So Equity Does Too

While everyone understands that home prices can change rapidly with market conditions, it’s also important to bear in mind that your equity changes in sync with those fluctuations since home value is a key piece of the equation.

So, calculating your home equity is not a one-and-done proposition. If you don’t plan to sell your house or borrow against it soon, you do not need to update the home equity calculation frequently.

But, it is helpful to be aware that equity does not stay static. In past economic cycles, recessions have caused home values to contract quickly. So if you look to your home equity as a source of borrowing power, remember that the amount you could borrow may shrink during an economic downturn.

How To Access Your Home Equity

Aside from selling your home, there are other ways to turn your home equity into spendable money. There are three main ways to borrow against the value of your home. Note that all these products charge interest and may have other fees such as appraisal costs.

Mortgage - This is a loan to purchase or refinance your home. You can do a cash-out refinance, which may be attractive if interest rates have dropped since you took out the original loan.

Home Equity Line of Credit or HELOC - This is a flexible, open-ended loan that lets you borrow in increments up to a set limit. You can repay what you borrow right away or over time, according to the terms. Interest starts accruing with your first draw on the line. A HELOC is secured by your home and can be a first lien or subordinate to your mortgage, meaning your mortgage lender would be paid first if you default.

Home Equity Loan or HELOAN - This is similar to a traditional loan, often with fixed interest rates. You borrow a defined amount of money that you receive in one payment when the loan closes. You then have a repayment schedule. Like a HELOC, a Home Equity Loan is secured by your home and can be a first lien or subordinate to your mortgage.

Homeowners often wonder how soon they can do home-equity financing. Lenders usually want you to wait at least two months after buying a home before seeking a HELOC or HELOAN.

Evaluate the pros and cons of these loans as you do with a mortgage, considering interest rates, term, fixed and variable rate options and costs. Decide which type of financing is best for you and talk to lenders.

Once you apply for the loan, the lender will have a professional appraisal done of your property. That cost is typically passed on to the borrower. Because the lender will require this even if you have had one done recently, most experts generally advise not to have your own appraisal done before you apply.

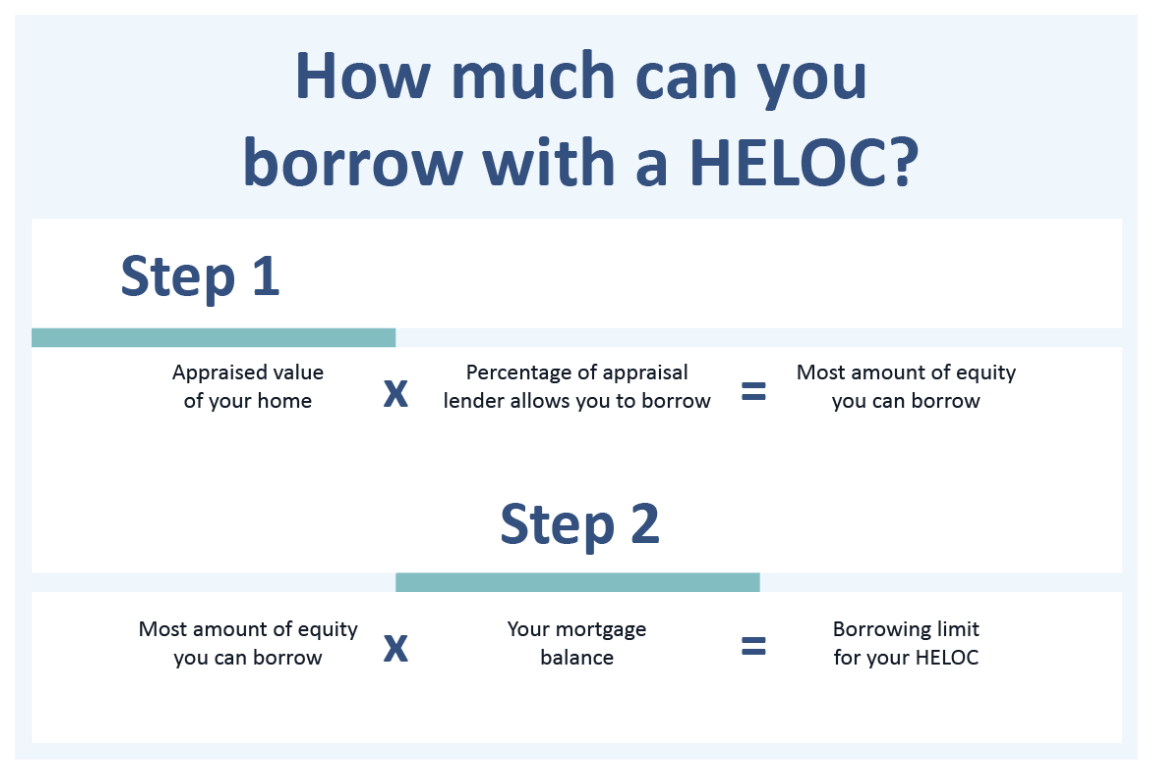

How To Calculate How Much You Can Borrow

Now you know the value of your equity, you can calculate how much you can borrow against that amount. This is done by considering debt as a percentage of the home’s estimated market value.

This is expressed as ratios called loan-to-value (LTV) and combined-loan-to-value (CLTV).

To calculate LTV, divide your equity value by the loan amount and multiply by 100. So, if your home is worth $400,000 and your mortgage is $240,000, you would do the following calculation.

$240,000/$400,000 = 0.60 x 100 = 60% LTV

Combined loan-to-value is nearly the identical calculation but it applies when there is debt secured by the home in addition to the mortgage. In this example, if there was also a $10,000 home equity loan, the CLTV would be derived by adding that to the $240,000 mortgage and doing the same math.

$250,000/$400,000 = 0.625 x 100 = 62.5% CLTV

These ratios are a way for lenders to assess the risk of extending these loans to you. Banks will not let you borrow the full amount of your equity because if you default and the value of your home falls, they risk not being able to recoup their money.

A high LTV also may indicate financial stress on a borrower, where a lot of their income is going to debt payments. Typically, banks will lend up to an 80% LTV or CLTV and sometimes 85% on home equity loans and HELOCs.

A lower LTV increases the likelihood that a bank will approve your loan application. Beyond equity, lenders will also check your credit score and debt-to-income ratio.

What Is the Most You Can Borrow?

To determine the size of the home equity loan or line of credit you could seek, look at the difference between your current LTV and 80%. In the example above, where the LTV was 60%, there are 20 percentage points between LTV and the bank’s maximum 80%.

Borrowing an additional 20% of the home’s $400,000 value would be $80,000. That would change the combined loan-to-value rate to 80%.

$240,000 + $80,000 = $320,000/$400,000 = 0.80 x 100 = 80%

So in this scenario, the borrower could reasonably seek an $80,000 equity loan.

What Is the Cheapest Way to Get Equity Out of Your House?

The least expensive way to take equity out of your house with a loan will depend on variables like interest rates, fees and length of loan. Compare the options available to you.

Home equity lines of credit (HELOCs) generally only charge interest on the actual amount you have borrowed. So, if you plan to use the money for a house upgrade that will have expenses over time, you may be able to reduce your interest expense with a HELOC. A HELOC lets you draw money on the line as and when you need it.

A Home Equity Loan or HELOAN would start accruing interest on the full amount at closing.

Pros and Cons of Home Equity Loans and Lines of Credit

As you consider HELOCS and HELOANS, you will want to consider the benefits and drawbacks, and compare them to other financing options.

The pros of home equity financing include:

- Source of money for worthwhile uses like home improvement or paying down higher interest rate debt as well as emergencies.

- Lower interest rates than credit cards or personal loans

- Potential for interest to be tax deductible depending on individual circumstances

The cons of home equity financing include:

- Risk of foreclosure on your home if you don’t make payments

- Added monthly expense

- Possible fees for appraisals and other closing costs

- If you sell your home, the amount you receive will be lower because you will have to pay off the additional financing as well as any remaining balance on your mortgage.

Frequently Asked Questions About Home Equity Loans

- Is it a good idea to take equity out of your home? The answer depends on your personal circumstances such as what you plan to do with the money. If you are making home repairs or renovations that increase the value of your home, that could more than pay for the cost of the loan. But because the roof over your head is at risk in a foreclosure, avoid tapping equity for purposes like vacations or daily necessities, except in an emergency. Also, consider your budget and whether you can afford monthly loan payments.

- How do I build equity in my home? There are lots of techniques to increase your home equity including making a large down payment, making extra mortgage payments to pay it down more quickly, refinancing to a shorter term, and avoiding private mortgage insurance (which usually requires at least a 20% down payment). You can also increase the value of your home with smart home improvements like making it more energy efficient or updating the kitchen. Lastly, be patient: Home values tend to appreciate over the long term.

- Can I take equity out of my home without refinancing? Yes, both home equity loans and lines of credit, discussed above, allow you to borrow against your equity without refinancing your mortgage.

What are the costs associated with a home equity loan? There are some fixed fees for items such as appraisal, filing and notary, credit report and title search. There are also costs calculated as a percentage of the loan amount, such as origination fees and title insurance.

How do equity loans affect PMI? If you have made less than a 20% down payment, you probably have private mortgage insurance (PMI). Once your equity reaches 20% of your home value, this cost is eliminated. However, if you are still paying for PMI and your CLTV increases because of a home equity loan, the cost of your PMI premiums could rise and you would delay reaching 20% equity. PMI only applies to your primary mortgage. So if you seek a home equity loan after hitting the 20% threshold and dropping PMI, it won’t be a factor in your home equity loan or HELOC.

Can you get an equity loan or HELOC if you don’t have a mortgage? Yes, you have a lot of equity in your home to borrow against. Lenders view this situation favorably. However, you will want to evaluate all the options including obtaining a primary mortgage by comparing interest rates and terms.

What are the alternatives to equity loans? There are a lot of financing options that tap into your home equity starting with a cash-out refinance, which replaces your primary mortgage. We have already discussed the home equity line of credit (HELOC) and loan. Beyond these, the alternatives can get complex, and you’ll need to do your research. Some are only advisable in certain situations. These include: reverse mortgages, bridge loans, home equity sharing and rent-back agreements. If you are looking for loan alternatives that are not tied to home equity, there are personal loans, credit cards, personal lines of credit, and loans against retirement accounts in certain situations.

If you still have questions on whether a home equity solution is right for you, the First Fed mortgage team is happy to help you find the best solutions for your financial goals. Or, if you are ready to get started, you can apply online for a Home Equity Loan or Line of Credit.

Home Equity

Home equity loans or lines of credit deliver more flexibility and lower-interest rates than most unsecured personal loans.

Meet the Mortgage Team

Our local mortgage experts can guide you through the home-buying process to find the best solutions for your needs.