Understanding the 2023 FHFA Mortgage Fee Changes

The Federal Housing Finance Agency (FHFA) recently announced updates to Loan Level Pricing Adjustments (LLPAs) for certain mortgages backed by Fannie Mae and Freddie Mac, which comprise roughly half of the mortgages in America. These changes went into effect on May 1, 2023. This is the first major overhaul of the LLPAs since they were implemented by the FHFA in 2008.

What are LLPAs?

Fannie Mae and Freddie Mac LLPAs are based on a risk-assessment matrix, and therefore are unique to each individual borrower based on their specific scenario. Borrowers with higher risk factors will pay more than a borrower with lower risk factors.

Factors include but are not limited to, a borrower’s credit score, loan-to-value, loan purpose, property type, and property occupancy. LLPAs are cumulative, so a borrower could have none, one, or several risk factors that apply to their transaction, depending on the loan scenario.

Will borrowers with higher credit scores pay more in LLPAs than before?

The short answer is maybe. With the updated LLPAs, some borrowers will see an increase while others could see their fees decrease or remain flat.

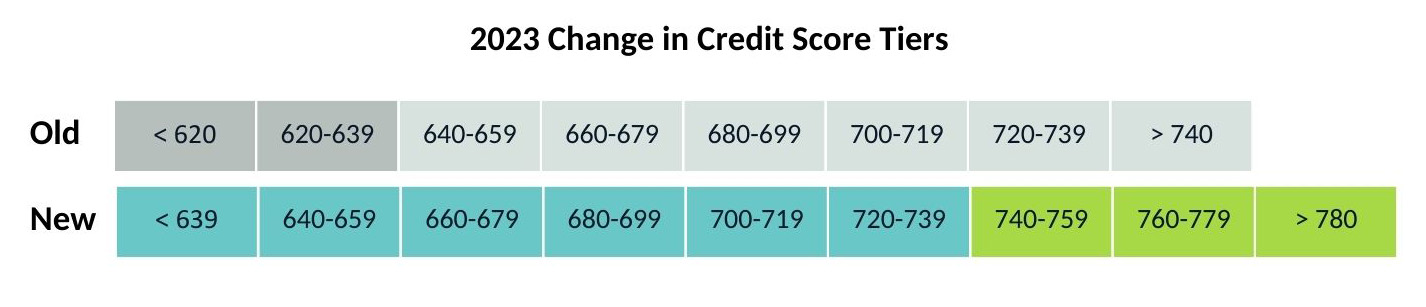

One of the reasons fees have changed for some borrowers is that the new LLPA structure added additional tiers to its credit score risk assessment. Prior to the change, all borrowers with credit scores 740 and higher were priced the same. Now there are three new tiers: 740-759, 760-779 and 780 and above. Those borrowers may face a small fee increase under the new fee structure compared to before the change. However, not all borrowers with higher credit scores will pay more today than they would have paid prior to the change.

It's worth noting that in the same loan scenario, borrowers with higher credit scores will always pay less in LLPAs overall than borrowers with lower credit scores.

How are borrowers with lower credit scores affected?

One of the FHFA goals for the LLPA changes was to make the cost of financing a mortgage more affordable to borrowers with lower down payments and lower credit scores. Borrowers may now find lower fees associated with lower credit scores, particularly if they do not have a down payment of 20%.

Borrowers without 20% down are required to take out and pay private mortgage insurance (PMI). This reduces the risk to Fannie Mae and Freddie Mac by passing that risk on to the mortgage insurer, which results in reduced LLPA fees.

Even though the new LLPA structure may reduce fees for some borrowers with lower credit compared to before the change, borrowers with higher credit scores still most likely pay less fees overall. It’s always best to understand where your credit score is and what you can do to increase it. Working with an experienced mortgage lender early in your buying process can help you understand how your credit score impacts your scenario and what you could possibly do to improve it.

Are there ways to avoid the LLPA fees?

While the new LLPAs apply to a significant number of mortgages being originated today, there are several alternative loan products that are not subject to these new LLPAs. Specific Fannie Mae and Freddie Mac loan programs, such as Home Ready and Home Possible waive or significantly reduce LLPAs, for eligible borrowers.

Additionally, the following loan types are not secured by Fannie Mae or Freddie Mac, so they are not subject to these new LLPAs: USDA Rural Guaranteed Home Loans, VA Home Loans, Jumbo/Non-Agency Loans, and Portfolio Loans.

What if I have more questions?

First Fed mortgage experts understand the intricacies of mortgage pricing, and the changes that were recently implemented. They can walk you through your particular loan scenario and help find the best mortgage solutions for your home financing needs. If you have any questions about the new LLPAs or you are preparing to purchase a home, refinance your existing mortgage, or build a new home, please reach out to one of our

Mortgage Loan Officers. We are happy to help.