THE NEW BUSINESS BANKING EXPERIENCE

Faster. Smarter. More Flexible.

We’ve taken Business Digital Banking to the next level to bring you a faster, more powerful, and adaptable platform. Designed to grow with your business, our new digital banking features will help you manage your finances more efficiently—today and in the future.

Getting Started Made Easy

Our team is dedicated to ensuring your transition is seamless. Browse the FAQ and support resources below, or reach out to us directly if you need any help. We’re here to make sure you get the most out of your new Business Digital Banking experience. We're excited for you to explore the enhanced features and enjoy the added convenience, flexibility, and efficiency tailored to your business needs!

Explore What’s New

in Business Digital Banking

Features

Here are some of the improvements that you’ll find in our new platform:

Powerful cash flow and forecasting tools to support your business’s payables and receivables

A unified view of all your business accounts, even external ones, giving you the power to move money across financial institutions with ease.

Enhanced security with additional safeguards to better protect your account

Improved self-service and admin tools that give you more control and flexibility, including adding users and sub-users to your Business Digital Banking.

Seamless navigation across desktop and mobile for consistent, user-friendly experience

We upgraded to Business Digital Banking to better serve your evolving needs. This enhanced platform is designed with your feedback in mind, offering stronger security, smarter tools, and a more intuitive user experience.

This upgrade is an investment in your success. Our commitment to innovation ensures your banking is not only secure but also faster, simpler, and more convenient. We’re here to help you navigate your business journey with greater ease, so you can focus on what matters most.

Setup FAQ

Please refer to the login instructions included in your Upgrade Letter, which was mailed to you last week. All users will be prompted to reset their password during their first login to the new platform.

To help keep your accounts secure, users with ACH and/or wire access will also be required to use a security token to access Business Digital Banking after their initial login.

Yes. If you're a current token user, or have ACH and/or wire access, you’ll need to set up a new token to access Business Digital Banking. If you haven’t set one up yet, visit our Token FAQ page for instructions.

To switch your security code delivery method from the default email option to SMS or phone call, please visit our Security Code Delivery Setup page for step-by-step instructions.

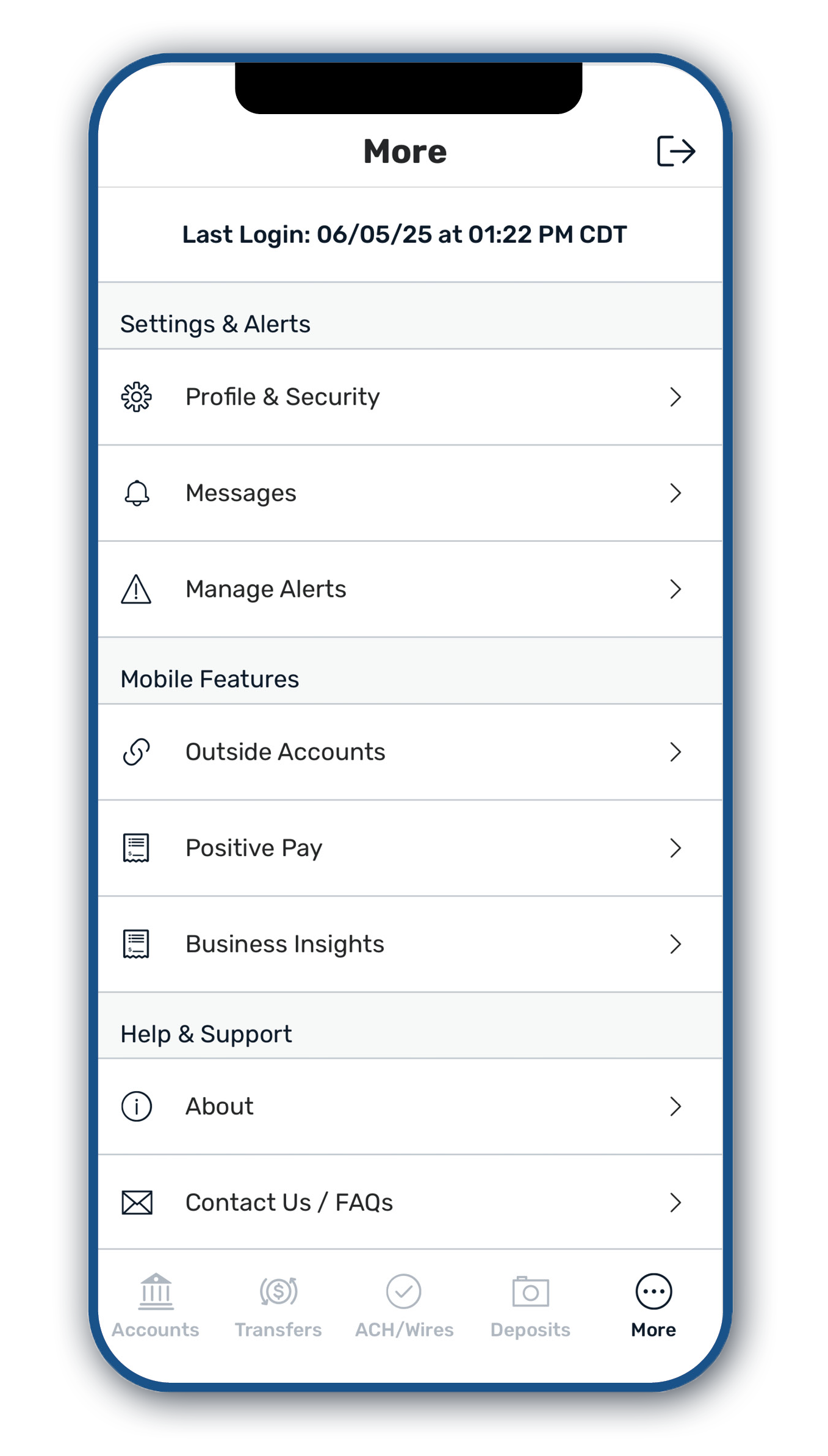

Learn more about our Business Mobile Banking app and download it here.

Your scheduled payments and templates were transferred to the new platform. However, start dates and next payment dates must be added again. Please reenter timing details in the new platform to ensure uninterrupted transactions.

Yes, all your account information and transaction history were automatically transferred to the new platform. Additionally, you will now be able to view pending debit card activity!

Yes, your Bill Pay details including future payments and recurring payments, were transferred to the Business Digital Banking platform. Please note Bill Pay will not be available in the mobile app. For more information view our Bill Bay Support Page.

Yes, the new platform does support QuickBooks/Quicken. However, you will have to reconnect your QuickBooks/Quicken account. View our QuickBooks/Quicken Support Page.

Now you can access powerful Business Insights—like cash flow trends and profitability forecasting—directly from your Business Digital Banking dashboard. Ready to get started? Visit our Business Insights page to learn how to sign up.

In Business Digital Banking, accounts are shown based on the primary administrator’s access. If the primary administrator is also a signer on an account, and subusers had access to that account before, it was added to the administrator's profile to make sure the subusers keep their access. As a result, only primary administrators may see more accounts in Business Digital Banking than they saw in Business Online Banking. If you are a primary administrator, please review all subusers the first time you log in!

Support Guides: Your Resource for a Smooth Transition

We're here to support you every step of the way as you set up your account and explore the new features available in Business Digital Banking. Our goal is to make your experience seamless and stress-free.

As you navigate the platform, you’ll have access to interactive Help guides that offer easy, step-by-step instructions. Whether you're learning new tools or adjusting settings, you’ll find the support you need right where you need it.

How to Use Help Guides

In addition, we’ve provided helpful videos and support pages below to guide you through key setup steps, ensuring you are up and running quickly.